Understanding the 2025 Social Security COLA Increase

The Cost of Living Adjustment (COLA) is an annual increase in Social Security benefits designed to protect the purchasing power of recipients against inflation. The COLA ensures that benefits keep pace with rising prices, allowing beneficiaries to maintain their standard of living.

Calculation of the Social Security COLA

The Social Security Administration (SSA) calculates the COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W measures the average change in prices paid by urban wage earners and clerical workers for a basket of consumer goods and services. The COLA is calculated by comparing the CPI-W for the third quarter of the current year to the CPI-W for the third quarter of the previous year.

The COLA is calculated as follows: COLA = (CPI-W for the third quarter of the current year – CPI-W for the third quarter of the previous year) / CPI-W for the third quarter of the previous year.

Historical Trends in Social Security COLA Increases

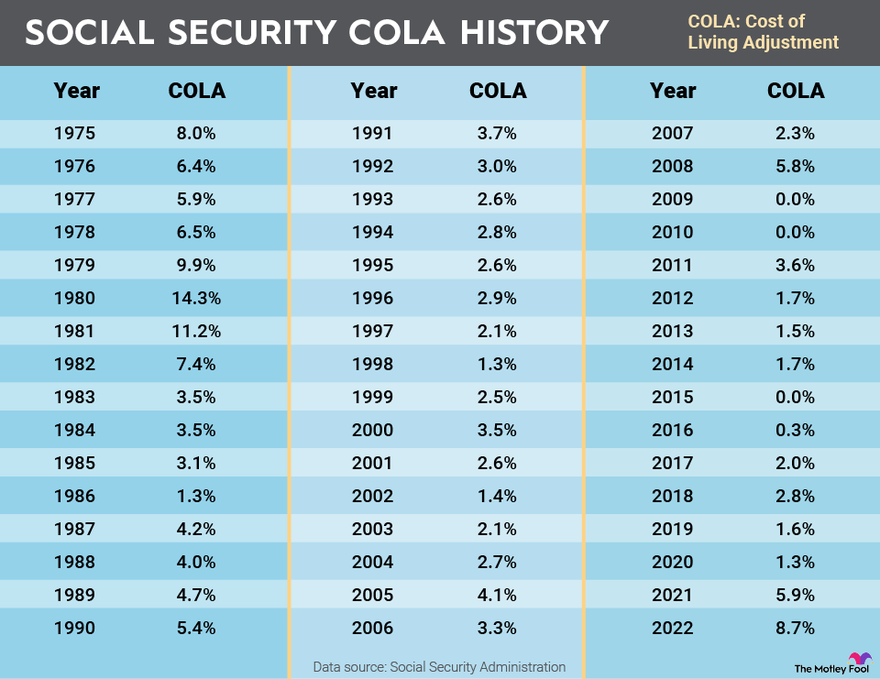

The COLA has fluctuated over the years, reflecting changes in the rate of inflation.

- In periods of high inflation, such as the 1970s and early 1980s, the COLA was significant, sometimes exceeding 10%.

- During periods of low inflation, such as the 1990s and early 2000s, the COLA was smaller, sometimes less than 3%.

- In recent years, the COLA has been more moderate, ranging from 1.6% to 8.7%.

Impact of the 2025 COLA Increase on Beneficiaries

The 2025 Social Security COLA increase will have a significant impact on the financial well-being of millions of beneficiaries across the United States. This increase will affect the monthly payments received by retirees, disabled individuals, and survivors, influencing their ability to meet their essential needs and maintain their standard of living.

Impact on Different Groups of Beneficiaries

The 2025 COLA increase will affect different groups of Social Security recipients in varying ways.

* Retirees: For retirees, the COLA increase will provide additional income to help offset the rising cost of living. This increase will be particularly beneficial for those who rely heavily on Social Security benefits as their primary source of income. For example, a retiree receiving $1,500 per month in benefits could see an increase of $150 per month with a 10% COLA.

* Disabled Individuals: The COLA increase will also provide much-needed financial relief for disabled individuals who rely on Social Security Disability Insurance (SSDI) benefits. This increase will help them cover essential expenses such as housing, healthcare, and food.

* Survivors: The COLA increase will also impact survivors who receive benefits based on the earnings of a deceased spouse or parent. This increase will help them maintain their standard of living and meet their financial obligations.

Impact on Purchasing Power, 2025 social security cola increase

The 2025 COLA increase is intended to help beneficiaries maintain their purchasing power in the face of rising inflation. However, the effectiveness of this increase will depend on the rate of inflation. If inflation outpaces the COLA increase, beneficiaries may still experience a decline in their purchasing power. For example, if the COLA increase is 5% but inflation is 7%, beneficiaries will effectively lose 2% of their purchasing power.

Impact on the Social Security Trust Fund

The 2025 COLA increase will have a significant impact on the Social Security trust fund. The trust fund is a collection of government bonds that are used to pay benefits to current beneficiaries. When benefits increase, the trust fund must be drawn down to cover the additional costs. This can lead to a depletion of the trust fund, which could ultimately lead to benefit cuts in the future.

The Social Security Administration estimates that the trust fund will be depleted by 2034, at which point benefits will need to be cut by about 20% unless Congress takes action to address the long-term solvency of the program.

Considerations and Perspectives on the 2025 COLA Increase: 2025 Social Security Cola Increase

The 2025 Social Security COLA increase, while providing much-needed financial relief for many beneficiaries, also highlights the complexities and challenges facing the Social Security system. Examining this increase in the context of long-term trends and potential policy changes offers valuable insights into the future of this vital program.

Comparison to Historical Trends

The 2025 COLA increase is a significant one, but it is essential to consider its magnitude relative to historical trends. The average annual COLA increase over the past decade has been considerably lower, reflecting periods of low inflation and economic uncertainty. This comparison underscores the importance of understanding the factors driving COLA adjustments and their potential impact on beneficiaries over time.

- The 2025 COLA increase is a substantial one, reflecting the significant rise in inflation experienced in recent years. This increase provides much-needed relief for beneficiaries struggling with rising costs of living.

- However, it is important to note that the average annual COLA increase over the past decade has been significantly lower, averaging around 2.5%. This is due in part to periods of low inflation and economic uncertainty.

- This historical context highlights the variability of COLA adjustments and the need for a long-term perspective when considering the financial security of Social Security beneficiaries.

Challenges and Concerns

The Social Security system faces several challenges, including the long-term sustainability of the trust fund. These challenges raise concerns about the ability of the system to continue providing adequate benefits to future generations.

- The Social Security trust fund is projected to become depleted by 2034, meaning that the system will only be able to pay out about 80% of promised benefits. This is a significant concern, as it suggests that future generations may face a substantial reduction in their Social Security benefits.

- The trust fund’s depletion is driven by several factors, including an aging population, increasing life expectancy, and a decline in the ratio of workers to retirees. These demographic trends are putting increasing pressure on the Social Security system.

- Addressing these challenges will require thoughtful policy changes and a commitment to ensuring the long-term sustainability of the Social Security system. Failure to do so could have significant consequences for millions of Americans.

Policy Changes and Proposals

Numerous policy changes and proposals have been put forward to address the challenges facing the Social Security system and ensure its long-term sustainability. These proposals aim to maintain the program’s solvency while preserving the benefits promised to current and future beneficiaries.

- One common proposal is to increase the Social Security payroll tax. This could involve raising the current tax rate or expanding the taxable wage base. Increasing the payroll tax would generate more revenue for the trust fund, helping to address the projected shortfall.

- Another proposal involves raising the retirement age. This would reduce the number of years that beneficiaries receive benefits, thereby lowering the cost of the program. However, raising the retirement age could disproportionately affect lower-income workers who are more likely to have physically demanding jobs.

- Some proposals focus on reducing benefits. This could involve means-testing benefits, which would reduce payments for higher-income beneficiaries. Alternatively, benefits could be reduced across the board, potentially impacting all beneficiaries.

- Other proposals focus on reforming the COLA calculation method. This could involve adjusting the formula to better reflect current inflation trends or adopting a different index altogether. Reforming the COLA calculation could ensure that benefits keep pace with the cost of living while also ensuring the long-term sustainability of the program.

The 2025 Social Security COLA increase is a hot topic, with everyone wondering how it will affect their budget. While we’re all focused on our wallets, it’s also important to keep an eye on public health measures. Take, for example, the recent nassau county ban masks decision, which has sparked debate about individual freedoms versus community safety.

Regardless of your stance on this issue, remember that the 2025 COLA increase will likely have a direct impact on your everyday life.

The 2025 Social Security COLA increase is still a bit up in the air, but one thing’s for sure – those grandkids are gonna need a comfy place to chill while they wait for news! Get them a set of kids adirondack chair and table for their own little hangout spot, and maybe they’ll even forget to ask about the COLA increase for a few minutes.

Of course, once they do ask, hopefully the news is good!